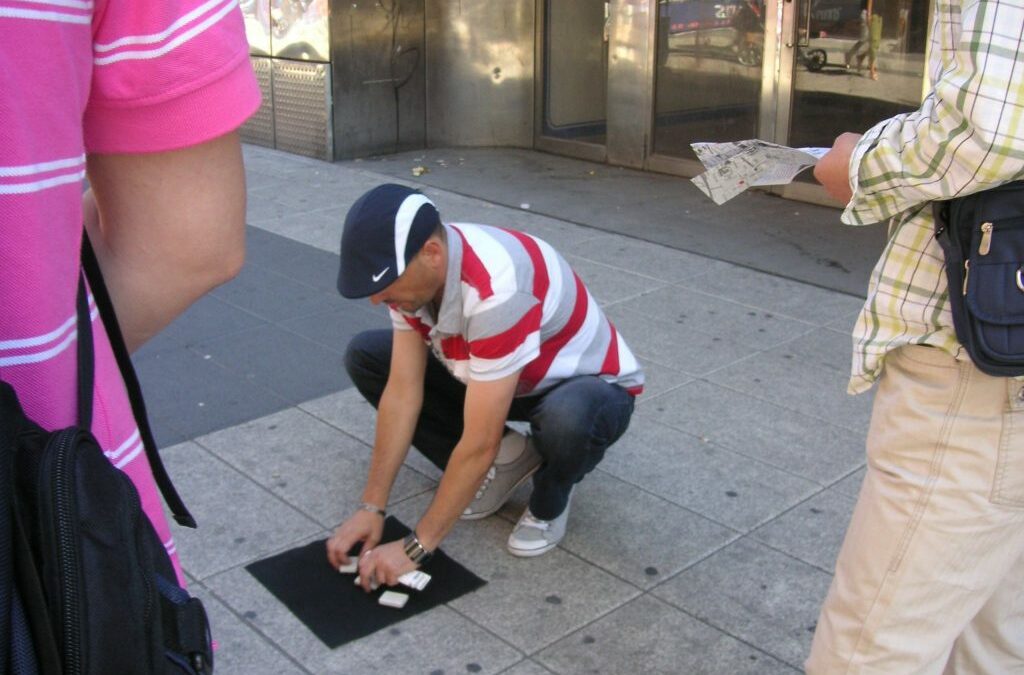

No one likes a scam, but will often fall for them. You can find them everywhere, on social media, in your email inbox, in your text messages, even answering the phone. It’s easy to play into a scam, the deals they offer sound so nice, right? Well, next time you’re tempted remember these five things:

- card

- arrest

- legal

- information

Card:

The minute someone asks you to pay with a prepaid card, get out of there. Usually scammers will ask for you to put money on a card and give them the card information. Having the easy access to your money and all the information they need to get it, it allows them to collect what they want simple and fast with little chance of getting caught.

Email:

When you see a good deal, it should not be given to you by an email domain that’s unofficial. A good rule of thumb is to always check the email. Your email may already filter out these types of domains to your spam folder but it’s always best to check anyway. If a company really wanted to contact you, they would not be using a Yahoo, Gmail, AOL, etc. domain.

Arrest:

We’re all afraid of being arrested and scammers know that. They will often threaten to arrest you if you do not pay them. What legitimate seller would do that? If you find yourself in this situation, stay calm. They want you in a panicked enough state that you’ll give them what they want. Think realistically, can they actually arrest you through the phone or computer? No. Do not reply to their text, emails, or phone calls.

Legal:

Scammers may stoop to threatening legal action. This especially occurs with debt collection scams; you’re told you owe money and they will sue if you do not pay it. A debtor has certain rights and the process of debt collection isn’t easy, keep this in mind. If you’re unsure of what you owe or if you owe anything at all, contact a consumer law attorney, they will go over your case for no charge. Always remember, if you’re skeptical of the legitimacy, do not proceed any further and contact someone who can actually help you clear things up.

Information:

There is basic information companies will need. For this, they will need to usually contact your bank for identity verification. There is no need they will need to contact you personally for this information, through any means of contact including email, phone, or private messages. If you’re skeptical, find out who is contacting you and verify them yourself.

Millions of Americans fall victim to being scammed, don’t let you be one of them.